Motivation

test

“Page Build Warning” email

These days, some of you must receive a “Page Build Warning” email from github after you commit happily. Don’t Worried! It just that github changes its build environment. View Live Hux Blog

In this mail, github told us:

You are attempting to use the ‘pygments’ highlighter, which is currently unsupported on GitHub Pages. Your site will use ‘rouge’ for highlighting instead. To suppress this warning, change the ‘highlighter’ value to ‘rouge’ in your ‘_config.yml’.

So, just edit _config.yml, find highlighter: pygments, change it to highlighter: rouge and the warning will be gone.

Boilerplate (beta)

Want to clone a boilerplate instead of my buzz blog? Here comes this!

Post Test

from datetime import datetime

from __future__ import division

import pandas as pd

from pandas import Series,DataFrame

from pandas.io.data import DataReader

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

%matplotlib inline

end = datetime.now()

start = datetime(end.year - 1,end.month,end.day)

s = DataReader("BABA",'yahoo',start,end)

#s.ix['2015-12-24']

s.head()

| Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2015-01-05 | 102.760002 | 103.019997 | 99.900002 | 101.000000 | 18337000 | 101.000000 |

| 2015-01-06 | 101.250000 | 103.849998 | 100.110001 | 103.320000 | 15720400 | 103.320000 |

| 2015-01-07 | 104.589996 | 104.739998 | 102.029999 | 102.129997 | 11052200 | 102.129997 |

| 2015-01-08 | 102.949997 | 105.339996 | 102.680000 | 105.029999 | 12942100 | 105.029999 |

| 2015-01-09 | 105.239998 | 105.300003 | 102.889999 | 103.019997 | 10222200 | 103.019997 |

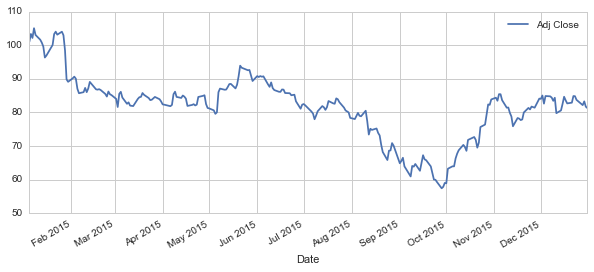

s['Adj Close'].plot(legend=True,figsize=(10,4))

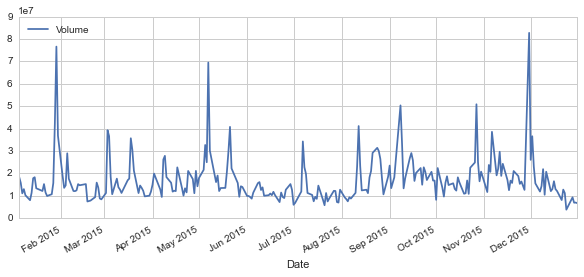

s['Volume'].plot(legend=True,figsize=(10,4))

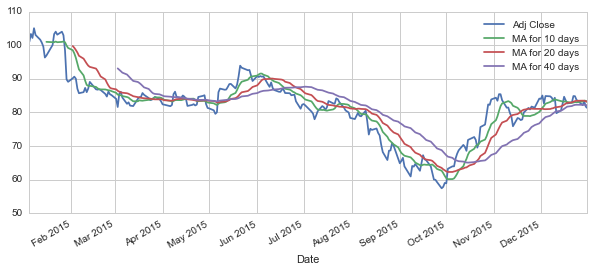

ma_day = [10,20,40]

for ma in ma_day:

column = "MA for %s days" %(str(ma))

s[column] = pd.rolling_mean(s['Adj Close'],ma)

s[['Adj Close','MA for 10 days','MA for 20 days','MA for 40 days']].plot(subplots=False,figsize=(10,4))

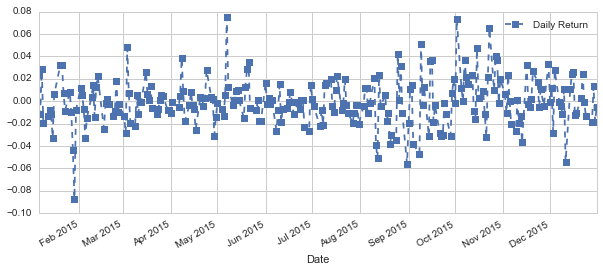

s['Daily Return']=s['Adj Close'].pct_change()

# print s['Daily Return']

s['Daily Return'].dropna().plot(figsize=(10,4),legend=True,linestyle='--',marker='s')

print s['Daily Return'].mean()

print s['Daily Return'].std()

-0.000642374946063

0.0213393676909

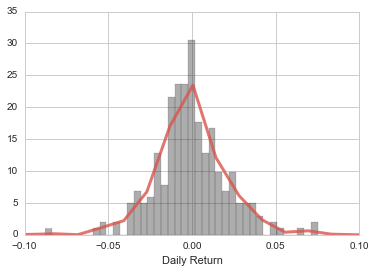

sns.plt.xlim(-0.1,0.1)

sns.distplot(s['Daily Return'].dropna(),color='0.2',bins=40,

kde_kws={"color": sns.xkcd_rgb["pale red"], "lw": 3,

"bw": 0.2,"alpha": .8})

# sns.kdeplot(s['Daily Return'].dropna())

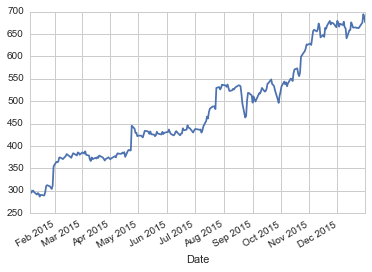

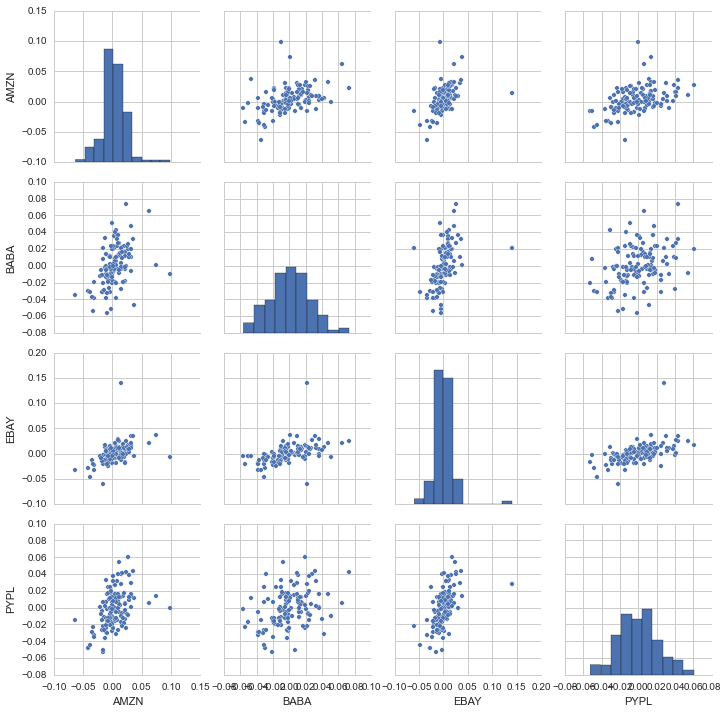

close_df = DataReader(['BABA','EBAY','AMZN','PYPL'],'yahoo',start,end)['Adj Close']

close_df['AMZN'].plot()

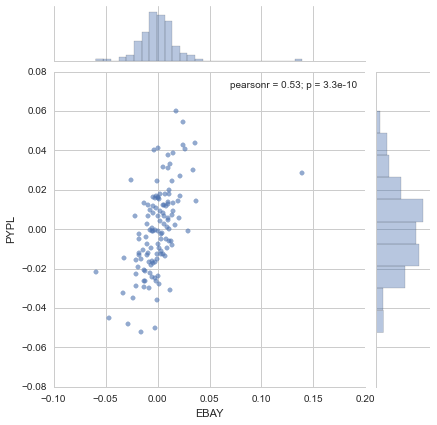

pct_df = close_df.pct_change()

sns.jointplot('EBAY','PYPL',pct_df,kind='scatter',joint_kws={'alpha':0.6})

sns.pairplot(pct_df.dropna())

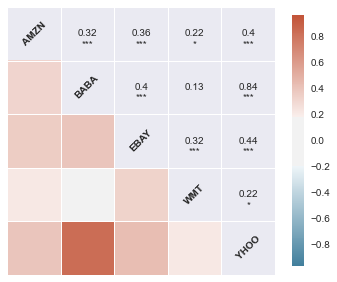

close_df1 = DataReader(['BABA','EBAY','AMZN','YHOO','WMT'],'yahoo',start,end)['Adj Close']

pct_df1 = close_df1.pct_change()

with sns.axes_style('darkgrid'):

fig, ax = plt.subplots(figsize=(6, 6))

sns.corrplot(pct_df1.dropna(),annot=True,

cmap=sns.diverging_palette(230, 20,sep=50,

n=7,as_cmap=True))

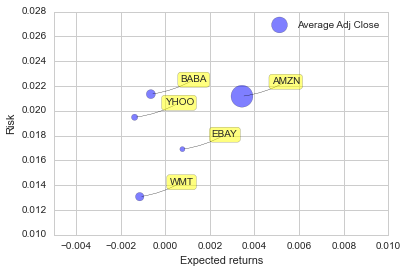

risk_df = pct_df1

plt.ylim([0.01,0.028])

plt.xlim([-0.005,0.01])

plt.xlabel('Expected returns')

plt.ylabel('Risk')

plt.scatter(risk_df.mean(),risk_df.std(),alpha=0.5,

s=close_df1.dropna().mean(),label='Average Adj Close')

plt.legend(loc=1)

for label, x, y in zip(risk_df.columns, risk_df.mean(), risk_df.std()):

plt.annotate(

label,

xy = (x, y), xytext = (30, 10),

textcoords = 'offset points', ha = 'left', va = 'bottom',

bbox = dict(boxstyle = 'round,pad=0.3', fc = 'yellow', alpha = .5),

arrowprops = dict(arrowstyle = '-', connectionstyle = 'arc3,

rad=-0.1'))

risk_df['BABA'].quantile(0.05)

-0.032540597138561403

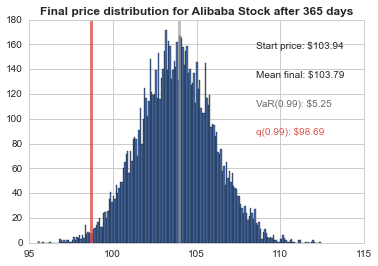

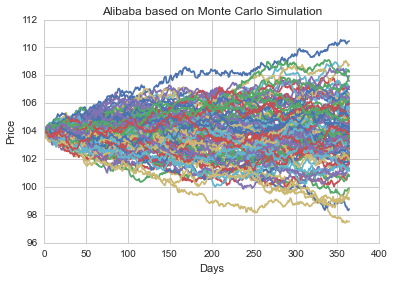

days = 365

dt = 1/days

mu = risk_df.mean()['BABA'] # drift of expected return

sigma = risk_df.std()['BABA'] # volatility of stock

def stock_monte_carlo(start_price,days,mu,sigma):

price = np.zeros(days)

price[0] = start_price

shock = np.zeros(days)

drift = np.zeros(days)

for x in xrange(1,days):

shock[x] = np.random.normal(loc=mu * dt, scale=sigma * np.sqrt(dt))

drift[x] = mu * dt

price[x] = price[x-1] + (price[x-1] * (drift[x] + shock[x]))

return price

start_price = 103.94

for run in xrange(100):

plt.plot(stock_monte_carlo(start_price,days,mu,sigma))

# plt.plot(s['Adj Close'])

plt.xlabel("Days")

plt.ylabel("Price")

plt.title('Alibaba based on Monte Carlo Simulation')

# Set a large numebr of runs

runs = 10000

# Create an empty matrix to hold the end price data

simulations = np.zeros(runs)

# Set the print options of numpy to only display 0-5 points from an array to suppress output

np.set_printoptions(threshold=5)

for run in xrange(runs):

# Set the simulation data point as the last stock price for that run

simulations[run] = stock_monte_carlo(start_price,days,mu,sigma)[days-1];

# Now we'lll define q as the 1% empirical qunatile, this basically means that 99% of the values should fall between here

q = np.percentile(simulations, 1)

# Now let's plot the distribution of the end prices

plt.hist(simulations,bins=200)

# Using plt.figtext to fill in some additional information onto the plot

# Starting Price

plt.figtext(0.65, 0.8, "Start price: $%.2f" %start_price)

# Mean ending price

plt.figtext(0.65, 0.7, "Mean final: $%.2f" % simulations.mean())

# Variance of the price (within 99% confidence interval)

plt.figtext(0.65, 0.6, "VaR(0.99): $%.2f" % (start_price - q,), color='.4')

# Display 1% quantile

plt.figtext(0.65, 0.5, "q(0.99): $%.2f" % q, color=sns.xkcd_rgb["pale red"])

# Plot a line at the 1% quantile result

plt.axvline(x=q, linewidth=3,color=sns.xkcd_rgb["pale red"],alpha=.8)

plt.axvline(x=start_price, linewidth=3,color='.6',alpha=.6)

# Title

plt.title(u"Final price distribution for Alibaba Stock after %s days" % days, weight='bold');